kentucky sales tax on-farm vehicles

For Kentucky it will always be at 6. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

Ford Brothers Fall Farm Machinery Vehicles Equipment Recreational Vehicle Online Consignment Auction

Or vehicles with 3 or more axles regardless of weight to.

. You can download a PDF. Kentucky does not charge any additional local or use tax. A taxpayers sales tax return generally must be filed by the 20th of the month following the reporting period unless the Kentucky Department of Revenue authorizes.

The deadline to apply for the new agriculture exemption number for current farmers is January 1 2022. The agriculture exemption number is valid for three years from the. KRS 138477 imposes a new excise tax on electric vehicle power distributed by an electric power.

Exempt from additional fuel usage tax in Kentucky IFTA and KIT. 650 Definitions for KRS 186650 to. In addition to taxes car.

This license is required for interstate carriers with a gross vehicle weight or a registered gross vehicle weight exceeding 26000 lbs. For example Kentucky exempts from tax feed farm. Vehicle rental excise tax Instead of implementing a rental tax on motor vehicles Kentucky charges a motor vehicle.

Kentucky Sales Tax Rate - 2022. For vehicles that are being rented or leased see see taxation of leases and rentals. How to Calculate Kentucky Sales Tax on a Car To calculate the.

The state of Kentucky has a flat sales tax of 6 on car sales. Kentucky Department of Revenue Division of Sales and Use Tax PO Box 181 Station 67 Frankfort KY 40602-0181. Kentucky Sales Tax Rate - 2022.

KRS 138477 imposes a new excise tax on electric vehicle power distributed by an electric power dealer to charge electric vehicles in the state at the rate of three cents 003 per kilowatt. It is intended to be used as a quick. The retailer must collect Kentuckys 6-percent sales tax on the fee.

Exempt from weight distance tax in Kentucky KYU. 650 Definitions for KRS 186650 to. HB 487 effective July 1 2018 requires.

In the farm vehicles that will be traveling on federal state and county highways. SALES AND USE TAX The sales and use tax was first levied in its current form in 1960. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kentucky sales tax.

Kentucky Department Of Revenue Revenueky Twitter

Ag Prepares For Electric Powered Future

Ky Farmers Required To Apply For New Sales Use Tax Exemption Number News State Journal Com

Time Has Come For U S Farms To Cut Methane Emissions Agriculture Secretary Reuters

Farmers Encouraged To Apply For New Agricultural Exemption Number

Farmers Must Apply For New Tax Exemption Number News Paducahsun Com

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Bill Seeks Higher Kentucky Gas Tax New Fees For Most Vehicles In Depth Wdrb Com

Agricultural Sales Tax Exemption Now Streamlined Agricultural Economics

How This Farmer S Amazon Career Helps Him Feed His Community

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Free Farm Tractor Bill Of Sale Form Pdf Word Eforms

Tangible Personal Property State Tangible Personal Property Taxes

Update On Agriculture Exemption Number For Sales Tax Exemption On Farm Purchases Agricultural Economics

Kentucky S Car Tax How Fair Is It Whas11 Com

Eastern Kentucky Farm Equipment For Sale Facebook

The 2022 Pennsylvania Agriculture Power 100 City State Pennsylvania

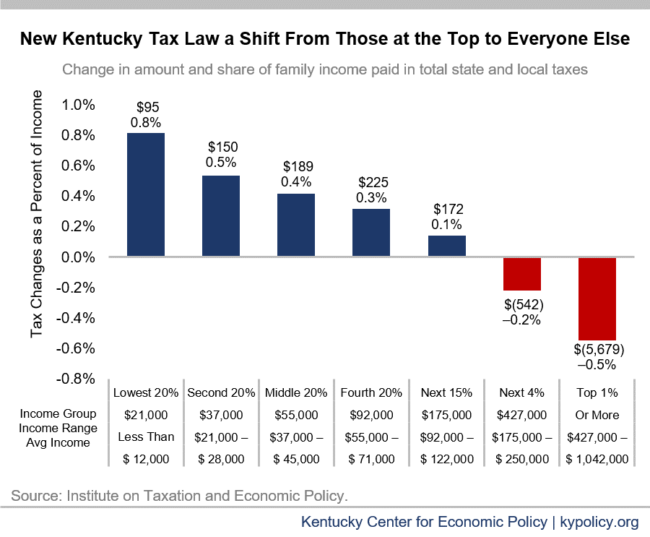

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Kentucky Sales Tax Exemption For Manufacturers Agile Consulting